Did you know that Universal Studios tried to buy SeaWorld? Of course! In Hollywood anything is possible. However, this is not current news. This is Samland.

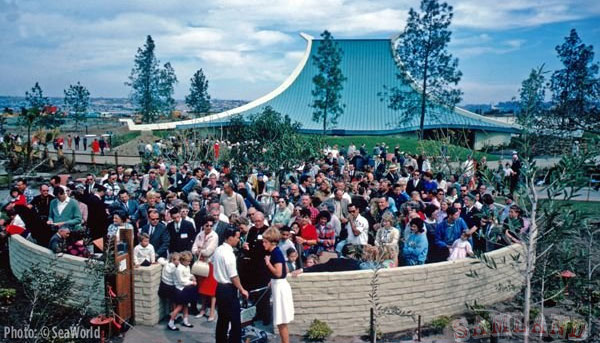

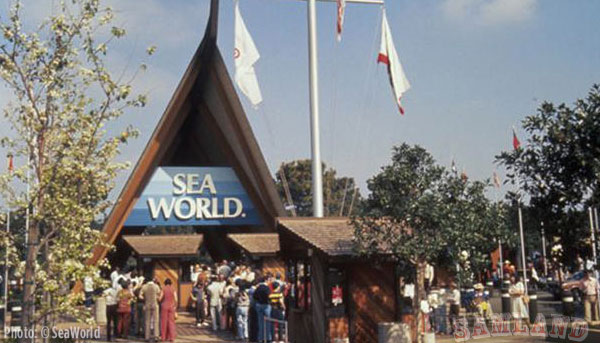

About the same time as MCA Universal was finalizing its first plans for the back lot tour in Hollywood, a group of UCLA graduates were about to open SeaWorld, a 22-acre marine park in San Diego. The park opened weeks before the first tram tour on March 21, 1964. SeaWorld was the brainchild of Milton C. Shedd, Ken Norris, David Demott, and George Millay. The park opened with six attractions and turned out to be a huge success right from the start with more than 400,000 visitors within 12 months.

Lew Wasserman (former head of MCA Universal) was very interested in acquiring the marine park from the very beginning. By the early 1970s, SeaWorld had grown to two parks, San Diego and Orlando. They were by far the leaders in their segment of the business. Wasserman and Jay Stein felt that adding the marine parks to the studio tour would firmly establish MCA as a major player within the industry. Buzz Price said of a SeaWorld acquisition, “MCA wanted it as a desirable building block for their position in the attractions business.” Better still, the marine park would be complimentary to the Studio Tour and not in competition with Disneyland.

Wasserman got his chance in October 1976. MCA was flush with cash from the success of Steven Speilberg’s Jaws and they decided to make a hostile bid for SeaWorld. They began by purchasing 8% of the available shares of stock and then offering $22 per share for the rest. The total value of the offer was $35 million. Buzz Price said, “This put the management into a state of shock because they were frightened by the perceived image and style of the men in black suits at MCA.”

To fight off the merger, SeaWorld hired investment banker, Kidder Peabody, and went looking for a white knight according to Buzz Price. A letter from Milton C. Shedd, chairman of Sea World Inc. stated “more could be obtained for our shareholders than pursuant to the MCA offer – and possibly on a tax-free basis.” They found their white knight in Harcourt Brace Jovanovic (HBJ), a publishing company. When HBJ made a slightly higher offer than MCA, the management at SeaWorld was relieved. It was their feeling that HBJ would be so busy with their publishing business that they would leave the marine park’s management alone.

When MCA heard of the new offer they considered whether to submit another bid. Mel Ziontz, who represented MCA in its acquisition efforts said, “When some of Lew’s people said MCA should make a higher offer, Lew started screaming! He said he wasn’t going to get in a bidding war and be made to look like a fool and pay more than the company was worth.” Jay Stein argued that it would be worth it and pressed Wasserman to make a deal. Wasserman refused. MCA dropped out and HBJ bought SeaWorld for $65 million or $30 per share. Upon reflection, Jay Stein suggested, “I only knew Lew to indirectly acknowledge a mistake one time, ten years after the fact but it was huge. He said ‘Maybe we should have bought SeaWorld.’”

As it turned out, HBJ was not a hands-off owner. After HBJ took over, they installed a management team that was made up of finance people. They decided to compete head on with other theme parks and move toward more live entertainment and away from their strength, animal shows. “Everybody wants to be in show business,” Buzz Price said. Mr. William Jovanovich would tell them to paint the fences orange and would direct other hands on attention, many of them capricious and authoritarian.” They also overbuilt. When they opened a new park in San Antonio, Texas, it was one hundred percent complete. With all the money gone, maintenance suffered and it was tough to add anything new. Even marketing dollars were cut.

Wasserman was not done yet. He started looking at other parks to acquire. In December 1979, he made a bid of $11.47 million for Cedar Point, an Ohio amusement park. Harold Hass, MCA’ treasurer said, “It’s a business with which we’re familiar. We see Cedar Point as a good investment.” The Cedar Point board rejected the MCA bid.

MCA made another attempt to buy Sea World when the marine parks were once again up for sale in August 1989.

HBJ was in trouble and subject to an unfriendly tender in the United Kingdom. To raise cash, they decided to put SeaWorld up for sale. This time there were plenty of suitors. MCA was interested. So was Anheusher Busch. Also bidding on the marine parks was a team of ex-managers lead by George Millay, Jan Schultz, and Bob Hillebrecht.

Buzz Price was hired by MCA to look at the properties and to make an assessment. He found the parks dirty and the workers rude. He felt that the only way to save the parks was to double the current levels of capital investment. Price recommended a bid of $700 million for the parks but MCA learned from the last experience and put in a bid for $900 million. It was still not enough. Anheusher Busch countered with a bid of $1.1 billion and was successful. Buzz Price said, “It was the best thing that could ever have happened to SeaWorld. It ended up in strong hands. Had MCA prevailed, SeaWorld would have been subject to four [now five] subsequent changes of ownership at the parent company level.” On October 19, 2009, SeaWorld was sold once again, this time to the Blackstone Group for $2.7 billion.

Would dolphin have made a good compliment to tram tours? We can only speculate. But It’s certainly a fun footnote in Universal and SeaWorld history.

You must be logged in to post a comment.