It’s all about synergy folks. Bob Chapek kicked off today’s Q3 investor call with a dissertation on the company’s focus on using all departments to push characters and stories across the Disney portfolio. While this call brought mostly good financial news, especially for the parks, as Disney’s earnings increased ten fold over the same quarter last year, things weren’t up across the board. Here’s the latest Disney Company news and some concerning trends:

Disney’s Mixed Financial Results for the 3rd Quarter

The Walt Disney Company has revealed their earnings the third fiscal quarter ended July 3, 2021. Diluted earnings per share (EPS) from continuing operations for the quarter was income of $0.50 compared to a loss of $2.61 in the prior-year quarter. Diluted EPS for the quarter increased to $0.80 from $0.08 in the prior-year quarter a 10 fold increase. But the diluted earnings per share for the nine months decreased 14% to $1.91 from $2.22 in the prior-year period.

“We ended the third quarter in a strong position, and are pleased with the Company’s trajectory as we grow our businesses amidst the ongoing challenges of the pandemic,” said Bob Chapek, Chief Executive Officer, The Walt Disney Company. “We continue to introduce exciting new experiences at our parks and resorts worldwide, along with new guest-centric services, and our direct-to-consumer business is performing very well, with a total of nearly 174 million subscriptions across Disney+, ESPN+ and Hulu at the end of the quarter, and a host of new content coming to the platforms.”

As a result of the company’s mediocre performance, the board decided to forgo dividends, a sure sign that the company isn’t as happy with results as they make it sound in their public statements.

Disney Parks, Experiences and Products (DPEP)

It was a good quarter for Disney’s parks and Consumer Products. Walt Disney World was at, or near, capacity for the entire quarter. Guest spending was up significantly at WDW and Disneyland due to pent up demand, which led to strong earnings.

“Yield-management” was used to maximize guest spending while keeping costs down. This is mainly due to park reservations, and pushing consumers to book as many things as possible online and in apps instead of using physical Disney labor to make those reservations. We also suspect that Disney is operating with fewer employees per guest than before the shutdowns, but Disney hasn’t reported those sorts of details.

Disney Parks, Experiences and Products revenues for the quarter increased to $4.3 billion compared to $1.1 billion in the prior-year quarter. Segment operating results increased $2.2 billion to income of $356 million. Operating income for the quarter reflected increases at domestic and international parks and experiences businesses and at merchandise licensing and retail. Of course, the parks were closed for most of this period in 2020.

Growth in merchandise licensing was primarily due to higher revenue from merchandise based on Mickey and Minnie, Star Wars, including The Mandalorian, Disney Princesses and Spider-Man. The increase at Disney’s retail business was due to higher results at Disney Stores, most of which were closed in the prior-year quarter and the comparison to the write-down of store assets in the prior-year quarter. Ironically, Disney is now closing its physical Disney Store business and moving that business online and to strategic partnerships and licensing.

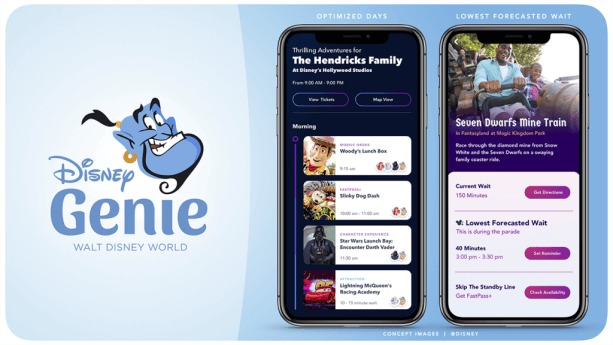

Disney Genie is rolling out soon at Walt Disney World. The service is expected to be a significant change over the current Disney Parks apps. The service will take consumer preferences and blend that with artificial intelligence to make suggestions to guests on the fly that will lead to “significant commercial opportunities” for Disney. This has us both excited and concerned. We aren’t sold that an increase in automation is actually better for guests, even though it is sure to increase the amount of money Disney makes off of you.

The impact of the Covid Delta Variant does not seem to be significant yet on the Disney Parks future bookings. The company remains bullish on Parks performance in spite of the current global pandemic. Park performance is “Exceptional” according to Disney’s CFO, who says she doesn’t use that term lightly.

Beyond the numbers, there wasn’t a lot that Bob gave investors to be excited about for the future of the Disney Parks creatively. He focused mostly on how well the parks were performing and how technology and cost containment would benefit shareholders.

Disney Media & Entertainment

This segment remains profitable, but there was a decreases in operating income. Increased production costs and decreased income led to a disappointing Q3. The performance of Raya and the Last Dragon and Soul in the current quarter compared to Star Wars: The Rise of Skywalker, Frozen II, Onward, Call of the Wild and Ford v. Ferrari in the prior-year quarter, along with lower catalog sales led to a decline versus the same quarter last year.

Streaming (Direct-to-Consumer) revenues for the quarter increased 57% to $4.3 billion and operating loss decreased from $0.6 billion to $0.3 billion. But that was mostly due to improved results at Hulu, as Disney+ had a higher loss than the previous year.

To help boost Disney+ performance, a special Disney+ Day will be held in November. New titles will be announced and the service will be promoted in all branches of the Disney Company in an attempt to convert Disney fans to subscribers.

But the upcoming slate of films sound a bit better than the ones of the past year. Among them are an original animated film with music from Lin-Manuel Miranda called Encanto, an untitled Indiana Jones pic, a new Avatar film, a couple of interesting looking Marvel pics, and a Steven Spielberg version of West Side Story among others.

What Disney Didn’t Disclose

We were shocked that Bob Chapek didn’t talk about the massive restructuring of the Disney company, including the current project to move all of Disney Parks, Experiences, and Products staff to Orlando by the end of 2022. That’s a massive project which will result in Disney losing much of their creative staff, including many of their older employees who have spent a lifetime working for Disney in California but unwilling to give up their lives to move to Orlando.

We’d like to know how many employees Disney is expecting will refuse the offer to move, how many jobs will be permanently lost, and how the parks in Florida and California will be run once everyone not based inside the parks is moved to a single facility in Orlando. What sorts of synergy and consolidation between operations is on the way?

While we understand that this will be a huge cost savings for Disney, the impact on the creative side of the parks and consumer products will likely be profound and the most significant shock to the company since the death of Walt Disney himself. And now we are hearing that even the Disney Media division is working on moving some operations out of California to a new studio in Canada. To say the sudden move of Disney’s creative core away from the massive creative communities in California and New York is shocking and something we had hoped the shareholders would have demanded answers about. Sadly, there was not a single question about this asked on today’s call.

2,000 Disney Parks, Experiences, and Products Jobs Moving to Orlando

Where Does Disney Go From here?

This investor call was a bit of a snooze compared to previous revelations. Bob Chapek kept to a tight and stilted script, few forward-looking statements or guidance was given, the company did not promote many upcoming projects. It felt strange and unlike the Disney investor calls of old (there wasn’t a hint of the showmanship of Michael Eisner or Bob Iger, much less the master showman of them all Walt Disney). The upshot of the call was that the parks are well on their way to full economic recovery, movies didn’t perform well, Disney+ wasn’t quite as golden as this time last year, but Hulu did well and Disney is rapidly expanding their streaming operations around the globe.

The Disney that we know and love is in a rapid state of change, not just the move to streaming, but how the parks are run and the service level guests can expect. We’re not sure how much more “yield-management” and automation the parks can sustain before they are simply too expensive and tedious to enjoy, regardless of how much we love the rides and characters.

We are reminded that Disney has always been at its best when it was lead by a creative visionary who had a financial Jiminy Cricket on his shoulder and not the other way around. Bob Chapek was forced into his new role at the worst of times, he has kept the company afloat and managed to squeeze a massive amount of bloat and cost out of the organization in the process. That was his job, and he did so well. But now that the tides are turning, we wonder when a creative visionary will return to Disney as the company seems to be in the process of purging creatives at all levels through restructuring, relocations, and the lack of a creative at the top of the pyramid to lead the way. For a creative company, it appears that there is an imbalance at the top, and that’s a concerning condition that it would be wise for the Board of Directors to keep an eye on. We aren’t saying that Bob Chapek needs to go, but he certainly needs a creative counterpart (and not just creatives who report to him) to keep the budget cutting and restructuring from becoming more important than the creative product Disney must continue to produce to maintain it’s leadership position.

You must be logged in to post a comment.